Forecasting, Analytics & Optimization

For Renewables and Energy StorageClosing the loop from planning to operation to maximize asset value.

CyberForum in Category “High Potential”

CyberForum in Category “High Potential”

EUPD Research in Category “AI Solutions”

EUPD Research in Category “AI Solutions”

the BW Ministry of Economic Affairs, Labour and Tourism

the BW Ministry of Economic Affairs, Labour and Tourism

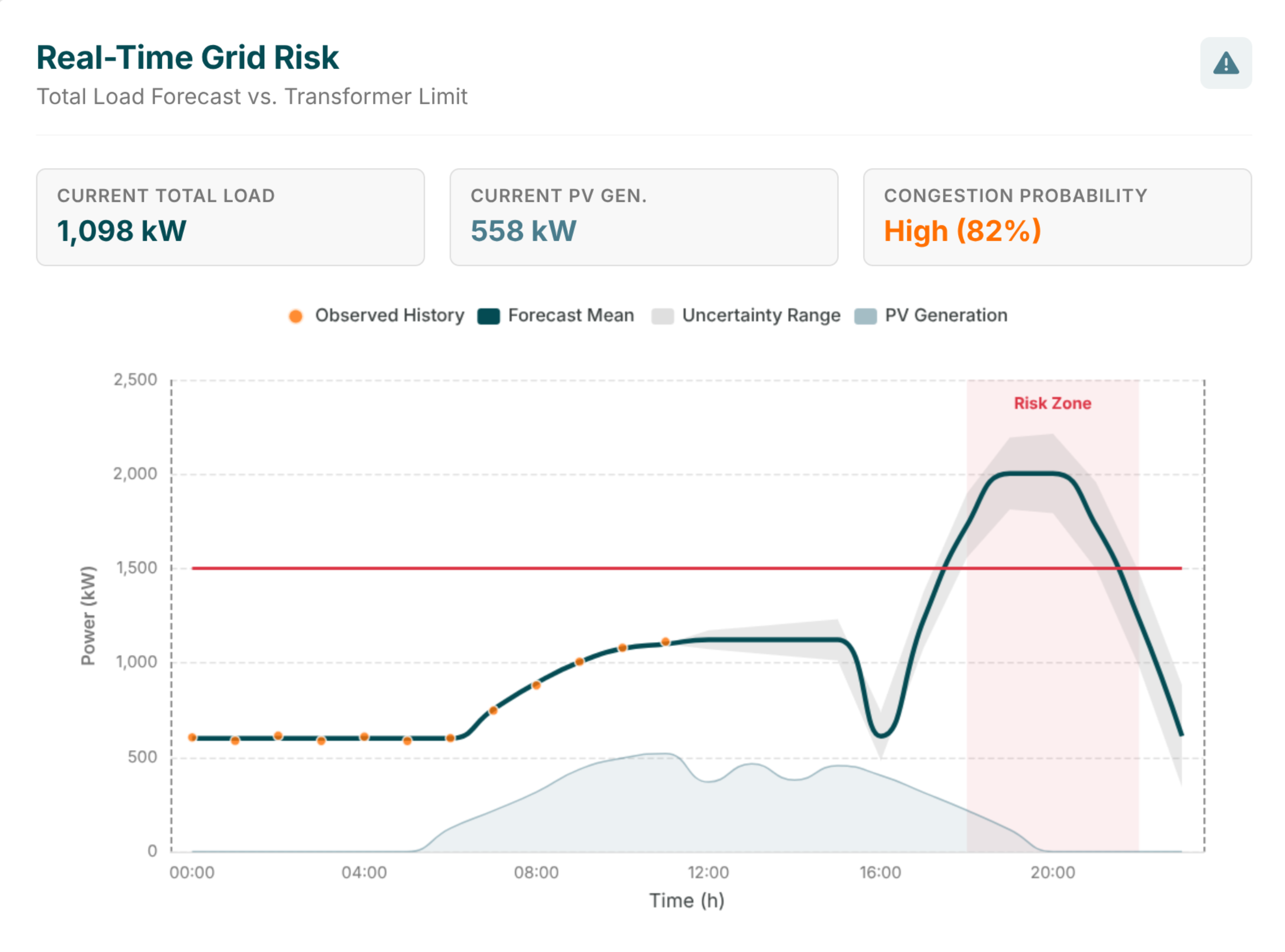

Legacy Systems Can’t Handle the New Grid Reality

The power landscape has inverted. Generation now follows the weather, and consumption must flex to match. Variable renewables drive system behavior, intraday volatility has become the norm, and balancing is enforced in shorter settlement cycles.

Forecast error

Forecast error is no longer a modeling issue, it is a balance-sheet risk. In high-frequency markets, even small deviation in generation or load forecast result in imbalance exposure and lost intraday optionality.

Flexibilities sitting idle

BESS and other flexible assets are dispatched via static rules or isolated optimizers, preventing co-optimization across peak shaving, market participation, and revenue stacking.

Black-box risk

Opaque forecasting and dispatch models limit traceability, and expose asset owners, operators, and balance responsible parties to financial, operational, and regulatory risk.

Reasonance Energy Intelligence Platform

The platform is a modular solution suite designed to bridge the gap between long-term strategic foresight and real-time operational execution for renewables and energy storage.

Techno-Economic Investment Evaluation

System Configration I Profitability Analysis I Revenue Stacking

Operation

Load Forecasting I Generation Forecasting I BESS Scheduling

AI-Powered Analytics

Asset Monitoring I Health & Performance Analytics

Built for stakeholders across the entire energy value chain

An End-to-End Intelligence Stack: Arc, Flux, and Horizon

From proprietary forecasting and dispatch models to enterprise connectivity, intuitive KPI visualization, and auditable reporting, Reasonance brings all capabilities you need together in a single platform.

ARC Engine

Forecasting and co-optimization engine, built on physical and process modeling, adaptive Machine Learning and stochastic optimization.

FLUX Connectivity

Standardized REST API for integration with existing EMS, ETRM, trading, and asset control environments without operational disruption.

HORIZON Interface

A visualization layer delivers KPI oversight and risk uncertainty to provide absolute traceability for every operational signal generated.

Balancing Cost Savings

with award-winning load and generation forecastingRevenue Uplift

with BESS scheduling optimization and value stackingFaster ROI

with investment simulation, profitability analysis and optimal asset sizingTailored solutions for your business needs.

Same technology core, multiple value outcomes. Select your role to learn how we can help you maximize the profitability and efficiency of your renewable and energy storage assets.

A Success Story

Techno-economic investment analysis for industrial microgrid

We performed a high-fidelity investment evaluation for a Swiss manufacturer with on-site PV and continuous industrial load to find the optimal behind-the-meter BESS configuration and operating strategy before capital commitment.

Investment-Grade Recommendations

Unified Intelligence for the Full Asset Lifecycle

Our solution suite provides seamless coverage from strategic planning to real-time execution, leveraging award-winning forecasting precision and deterministic dispatch solutions to optimize performance across the entire asset lifecycle.

Load Forecaster

Grid Disaggregation · C&I ConsumptionContext-aware intelligence.

Move beyond static patterns and historical averages with process-informed modeling.

Physics- & process-informed modeling (no black-box behavior)

Blind source separation for load unmixing, isolating grid demand from behind-the-meter PV

Multi-source data fusion integrating weather & event signals

Generation Forecaster

PV · HydroActive intelligence, not static data.

Physics-informed AI with continuous retraining.

Physics-informed modeling (no black-box behavior)

Adaptive model calibration for local & asset-specific effects

Multi-source data fusion to mitigate NWP bias

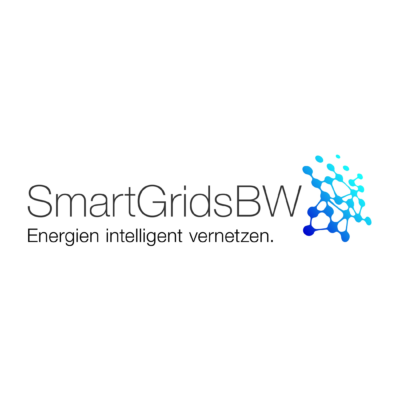

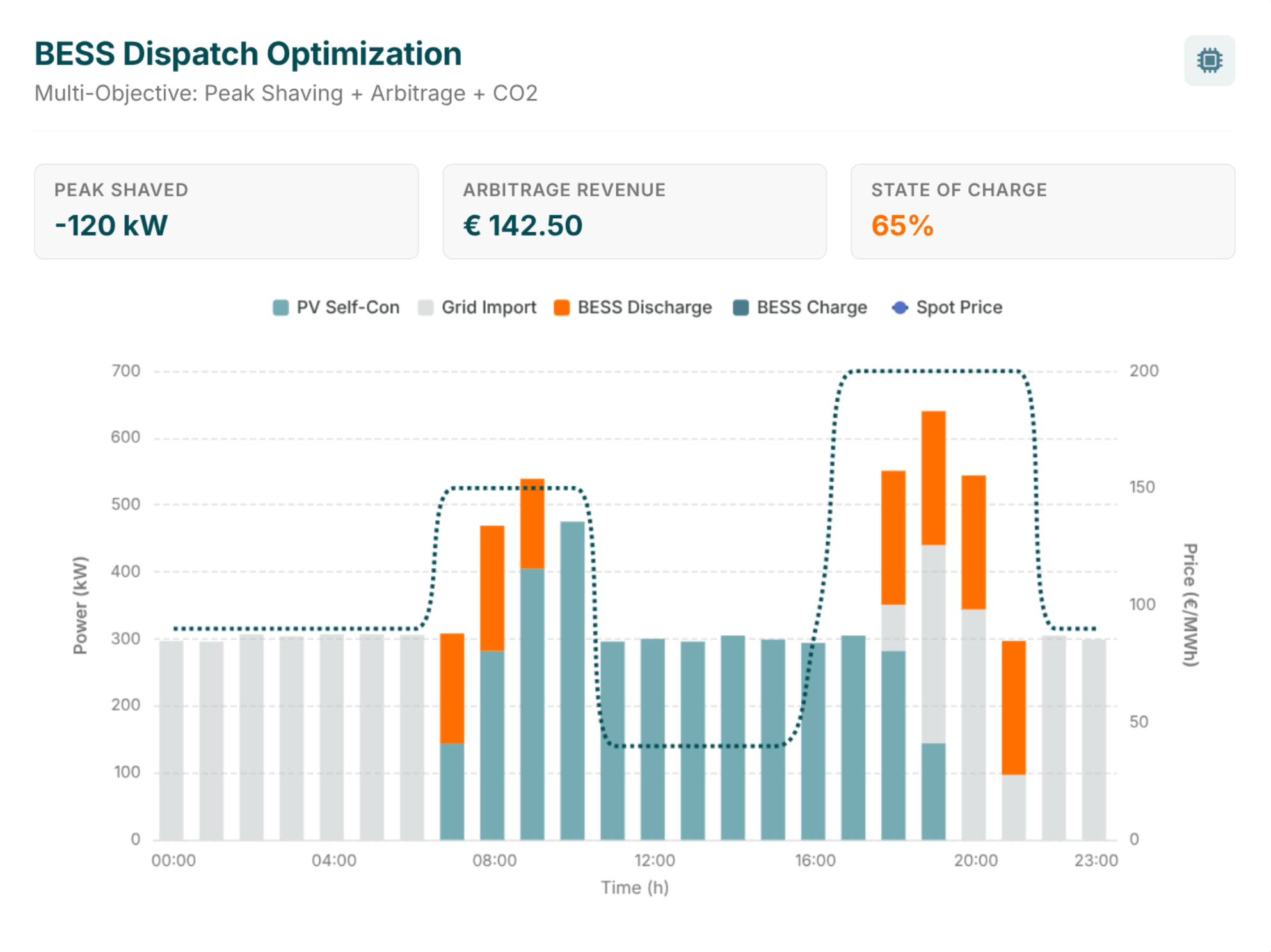

Dispatch Optimizer

BESS · Hydro · H2Glass-box execution.

Co-optimize RES, arbitrage, peak shaving, and ancillary services.

True mathematical optimization instead of black-box AI behavior

Multi-objective co-optimization engine

Rolling re-optimization under physical & market constraints

BESS Investment Analysis

BESS Sizing · CapEx · Due DiligenceDon’t guess. Simulate.

Move beyond simplistic spreadsheets with digital twin analysis for optimized investment decisions.

Stochastic 15-min simulation to capture intraday volatility

Physics-informed constraints reflect asset degradation & operational limits

Integrate proprietary or standard long-term price curves

One Brain. Total Context. Zero Assumptions

A technical foundation for safety-critical applications, fusing award-winning forecasting with deterministic multi-market co-optimization to maximize precision, reliability, and interpretability across every operational signal and system output.

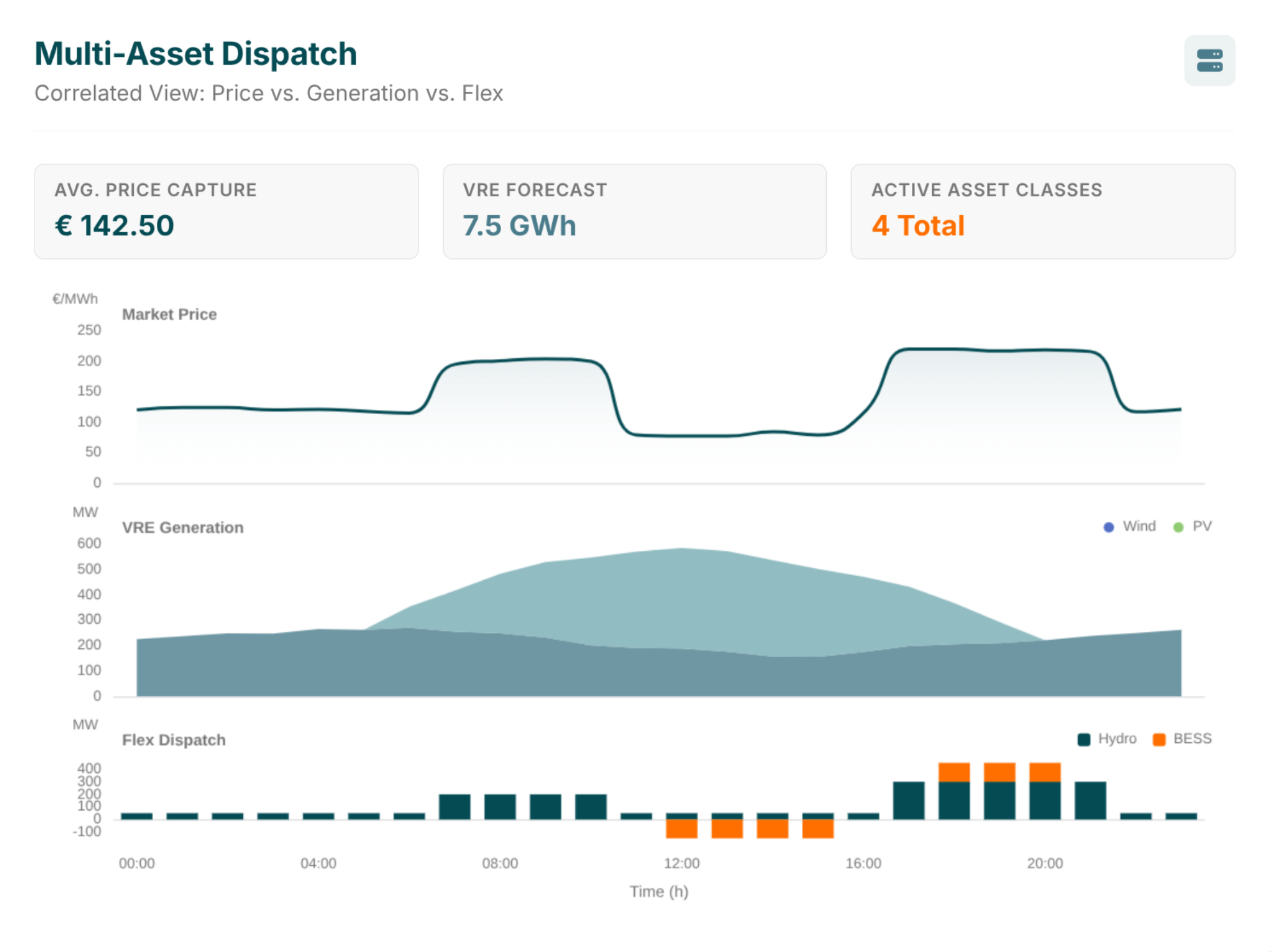

Physics-Informed Modeling

Our models learn how your asset actually behaves, inferring degradation, soiling, and efficiency losses from real observations. Every forecast is interpretable and comes with quantified uncertainty for rigorous risk management.

Glass-Box Logic

We replace black-box heuristics with MILP-based optimization under uncertainty, delivering mathematically provable, interpretable dispatch and trading decisions with traceability and a complete audit trail.

Holistic Co-Optimization

We jointly optimize markets, assets, and objectives in a single model, eliminating sequential heuristics and enabling provably optimal value stacking across arbitrage, flexibility services, and sector coupling.

Self-Correcting Forecasting

We fuse multiple weather sources and use your assets as measurement proxies to detect and remove systematic bias, delivering forecasts that improve continuously across all time horizons.

Flexible Integration

Deploy individual solutions or a fully integrated solution suite, depending on your use case.

Cloud-Native Scalability

We handle thousands of assets simultaneously, hosted in German data centers.

High Availability

Rely on > 99.5% SLA, engineered for continuous operation.

KRITIS-ready Security

Built on ZTA with VPN, TLS 1.3 encryption & OIDC-based identity management.

Reasonance in Numbers